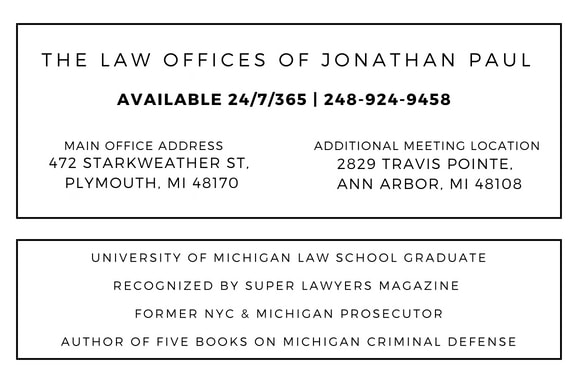

Michigan Retirement Asset Division - DV ChargesCall Me: 248-924-9458

|

If there are no other sufficient or equal material assets, then method #2 might be a couple's only option. When a couple gets divorced in Michigan, and has to share in the benefits of a retirement plan, it could cause a lot of tension or conflict, which the parties would rather have behind them; this is where method #1 might be the better choice if possible.

In Michigan, retirement benefits under the deferred division method, can be broken into two different forms of payment. The benefits can be dispersed as a shared payment, meaning the actual benefit payments are divided as they are made, between both spouses, or as a separate payment, which essentially creates two distinct benefits for two separate participants. The type of method available in Michigan divorces is subject to the type of retirement plan, and the status of the plan at the time of the division. In Michigan divorces, payments on retirement plans can also be periodic or lump-sum depending upon the plan, and the stage of the retirement benefit. A non-employee spouse may be able to call their own shots with disbursement or may have to adhere to the restrictions of the particular plan. |

Latest ArticlesShould I file for divorce first if my spouse falsely accused me of domestic violence?When will I be allowed back into my house and to see my kids?My wife wants to dismiss the case, why won't the prosecutor listen?Will I lose my job if charged with domestic violence?Can the prosecutor make my own kids testify against me in court?Can my spouse take away my retirement and savings if charged with Domestic violence?

What's the difference between a jury and a bench trial?

How can I get rid of a no-contact order?

|

|